Note. Search Data

Note. Search Data Allisson Silva dos Santos[i]*, ORCID: https://orcid.org/0000-0001-5121-9553; Universidade Federal da Paraíba, João Pessoa, Paraíba, Brasil.

Anderson Dias Brito[ii], ORCID: https://orcid.org/0000-0003-0783-3884; Universidade de São Paulo (USP/FEA), São Paulo, São Paulo, Brasil

Taciana Rita Santos Souza[iii], ORCID: https://orcid.org/0000-0002-1395-4896; Universidade Federal da Paraíba (UFPB). Instituto Federal de Educação, Ciência e Tecnologia do Sertão Pernambucano (IFSertãoPE), Petrolina, Pernambuco, Brasil.

Gabrielle Carvalho[iv], ORCID: https://orcid.org/0000-0002-0941-7270; União Brasileira de Faculdades (UniBF); Serviço Brasileiro de Apoio às Micro e Pequenas Empresas (SEBRAE) PE - Recife, Pernambuco, Brasil.

*Autor correspondente: allissonst@hotmail.com; Rua Governador Osvaldo Trigueiro, 95, Tibiri, Santa Rita, Paraíba, Brasil, 58304-000

Abstract

Evidence has emerged that culture shapes formal organizations and influences corporate governance practices. This study aimed to understand the current research on the relationship between culture and corporate governance, focusing on papers published in the last two decades. The methodology used was a systematic review of the literature, which determined the final sample of 23 articles based on specific inclusion and exclusion criteria. Some of the papers selected by the review indicate that culture may influence corporate governance practices. Understanding the cultural influences on governance is important, taking into account the specific context in which organizations are situated. Organizations should leverage the positive aspects of the culture in the country they are located in, as this can strengthen their operational mechanisms by influencing governance.

Keywords: culture; corporate governance; cultural influences; systematic review.

Resumo

Evidências têm surgido de que a cultura molda as organizações formais e influencia as práticas de governança corporativa. Este estudo teve por objetivo compreender o estado da arte sobre a relação da cultura com a governança corporativa, considerando os papers publicados nas duas últimas décadas. A metodologia utilizada foi a de revisão sistemática da literatura que definiu a amostra final com o quantitativo de 23 artigos a partir dos critérios de inclusão e de exclusão. Parte dos trabalhos selecionados pela revisão reflete que a cultura possui a capacidade de influenciar as práticas de governança corporativa. Dessa forma, compreender as influências culturais nas características de governança, considerando o cenário no qual as organizações estejam situadas se torna importante. As organizações devem utilizar de aspectos positivos da cultura do país onde estejam localizadas, pois ao influenciar a governança, seus mecanismos podem se tornar mais fortes.

Palavras-chave: cultura; governança corporativa; influências culturais; revisão sistemática.

Reference: Santos, A. S., Brito, A. D., Souza, T. R. S., & Carvalho, G. (2025). Culture and Corporate Governance: A Literature Review between 2000 and 2020. Gestão & Regionalidade, v. 41, e20258873. https//doi.org/10.13037/gr.vol41.e20258873

Corporate governance (CG) is a widely discussed topic in the corporate sector. It serves as a model to protect shareholders from conflicting behaviors of executives (Shleifer & Vishny, 1997). In a broader sense, the goal of corporate governance is to promote a positive relationship not only between shareholders and managers, but also among all the different stakeholders of the company. (Lopes, Valentim & Fadel, 2014).

To achieve organizational goals, executives need to show that they align with the interests of shareholders and other stakeholders. To facilitate this alignment, new governance mechanisms are emerging to mitigate the risk of expropriation and improve the well-being of the individuals involved in the organization (Rejchrt & Higgs, 2015). The evaluation of the CG's business can include factors such as board independence, gender diversity, board size, governance structure, board expertise, committee existence, independence from the board, and meeting frequency. The society in which the organization is located may heavily influence these factors (Humphries & Whelan, 2015).

The study of organizational culture has intensified since the late 1980s (Silva & Fadul, 2010). Culture can be viewed as a shared collection of different values within different social groups (Hofstede, 1980). In the corporate environment, organizational culture is responsible for directly influencing the way employees behave in relation to organizational strategies, goals and objectives. For organizations lacking CG practices and needing to introduce them, a cultural change supported by leadership is necessary. This is recognized as a challenging and long-term process (Lopes et al., 2014).

Evidence has shown that culture shapes formal organizations and influences CG practices (Gorga, 2004; Ntongho, 2016; Pessoa, Maia, Vasconcelos, & Luca, 2020). In view of these facts, there is a possibility that research will find answers to the following question: What has been studied about the relationship between culture and organizational leadership in the last two decades? Additionally, works published in 2020 were included. The survey results provide a current understanding of this relationship and depict the diverse realities of various cultures and styles of CG adoption. In addition, this work brings to light new research problems.

To date, there is no systematic literature review (SLR) that addresses the question raised in this research, which is one of the justifications for conducting this study. In addition to being an innovative review, it helps to understand the literature on the relationship between culture and CG.

There are five sections in the present research: The first section is the introduction. The second section deals with the theoretical basis. The third section presents the methodological procedures used in this systematic review of the literature. The fourth section deals with the analysis and discussion of the results. The fifth and final section contains the concluding reflections, highlighting the main findings, limitations and research questions still to be answered.

Culture can be defined as a shared set of different values between social groups, taking into account dimensions such as individualism, distance from power, aversion to uncertainty and the index of masculinity. Individualism reflects the importance given to the individual to the detriment of the group in society. The power distance considers the way societies see and deal with inequality of power and hierarchy. The aversion to uncertainty deals with the way cultures deal with uncertainties, ambiguity, and the unknown. The masculinity index considers the values assigned to male and female characteristics in a specific location (Hofstede, 1980).

Schein (1984) states that culture contains valid premises for a group that are communicated to potential new members of the group. These new members believe in and uphold the premises as correct in relation to society through artifacts and values. Artifacts are the visible and audible patterns of culture. Values constitute what should be and do. These elements are understood and consciously learned by the organizational group (Alvesson, 1989). The adoption of the premises can create internal harmony among the stakeholders.

D’Iribarne (1989) and Yeh and Lawrence (1995) are two authors criticizing the Hofstede model. (1980). D’Iribarne (1989) questions how the categories inserted in a questionnaire can define the culture of a place and its dimensions. In light of this, relying on statistical indicators to describe culture and predict outcomes for management might be unreliable. Yeh and Lawrence (1995) emphasize that the model makes a near-deterministic relationship between economic growth and culture, by which alone it would be able to explain this growth. Furthermore, the model does not account for differences between developed and underdeveloped locations, nor does it consider macroeconomic factors. Thus, given the model presented, certain cultural characteristics could be seen as fixed and unchangeable.

Alvesson (1989) criticizes Schein (1984) for defining the basic assumptions as so self-evident that they are not very variable within a cultural unit. In this case, if a fundamental assumption were widely accepted within a group, individuals would view behavior based on different assumptions as unimaginable, limiting broader perspectives.

In this study, we emphasize two cultural axes: national culture and corporate culture. National culture consists of habits and norms that create patterns, which are seldom questioned and are accepted by the social groups of a nation (Hofstede, 2001). Corporate culture is a grouping of norms and values that determine the beliefs, behaviors and habits of an organization's employees. (Smircich, 1983).

In the organizational environment, culture directly influences employee behavior in relation to corporate strategies and goals. For organizations without established CG practices that need to implement them, the issue of cultural change with leadership support arises, which is recognized as a difficult and long-term process (Lopes et al., 2014).

The type of culture adopted by an organization is linked to its financial performance For instance; Parente, Luca, Lima, and Vasconcelos (2018) found that European companies listed on the NYSE, particularly those with foreign open capital, are encouraged by collaborative cultures. This approach leads to improved performance, as it values the opinions of all employees for generating value.

In addition to influencing financial performance, research has shown that culture also shapes formal organizations and influences CG practices (Gorga, 2004; Ntongho, 2016; Pessoa et al., 2020). The topic of the CG will be examined in more detail in the next sub-section of this work.

Corporate governance emerged to meet the need to create mechanisms of protection, transparency and control in the face of the conflicting relationship between the principal and the agent (Shleifer & Vishny, 1997). The mechanisms developed by CG aim to maximize value for organizations in the long term (Ferreira, Lima, Gomes, & Mello, 2019). To reduce conflicts of interest, corporate governance mechanisms need continuous improvement.

Many authors conceptualize CG in different ways. However, the concepts usually converge to a system of power structures or a set of mechanisms in which companies are managed by third parties and in the implementation of which responsibilities and rights must be defined between the actors involved in maximizing value. In this view, the decision-making power in relation to the business model is not only in the hands of the shareholders The organizational actors involved include the board of directors, the tax committee, the shareholders, and the audit (Freitas, Silva, Oliveira, Cabral & Santos, 2018).

Companies with a strong commitment to corporate governance can reduce the risk of default and, through investments in their corporate image, maintain a favorable credit rating to be perceived as strong by society. Companies can promote efforts to enhance CG mechanisms in order to improve and ensure the continuity of corporate activities (Ola Al Haddad & Juhmani, 2020).

Agency theory is one of the theories that most discusses the importance of CG. According to agency theory, the separation of control and ownership activities must be provided by the complexity of the firms themselves, i.e. the existing agency relationships These relationships assume that one person or entity (the agent) must act on behalf of another person or entity (the principal), and contracts are entered into (Assumption, Luca, & Vasconcelos, 2017). In a broader sense, the CG aims to promote a positive relationship among the various stakeholders of the organization, not only focusing on the relationship between principal and agent (Lopes et al., 2014). To facilitate this alignment, the mechanisms reduce the risk of expropriation and improve the well-being of the individuals involved in the organization (Rejchrt & Higgs, 2015).

Companies regulated by corporate governance (CG) can be evaluated based on criteria such as board independence, gender diversity, board size, governance structure, director expertise, presence of committees, committee independence, meeting frequency, and other relevant factors. These factors may be shaped by cultural influences in the society in which the company is based (Humphries & Whelan, 2015).

In recent years, there has been a growing debate on environmental, social, and governance (ESG) issues, primarily driven by society and based on stakeholder theory. This theory considers building strong relationships with stakeholders as a vital tool for business performance (Freeman, Dmytriyev & Phillips, 2021).

ESG considers three dimensions: Environmental, Social and Governance. These dimensions are aggregated values resulting from the weighting of heterogeneous indices that include both internal and external characteristics of the company (Chiaramonte, Dreassi, Girardone, & Piserà, 2021). The environmental attribute includes sustainable practices and promotes the protection of the environment in the face of innovation, natural resources, climate change, pollution, waste, and environmental opportunities (Brogi & Lagasio, 2018; Chiaramonte et al., 2021).

The social dimension includes philanthropic activities, such as taking care of stakeholders, developing human capital, product stewardship, and social opportunities (Brogi & Lagasio, 2018). In relation to the individual, aspects such as diversity, job satisfaction, equality, health and safety at work and human rights can be mentioned, which are of greater importance (Chiaramonte et al., 2021).

The governance dimension involves maintaining good corporate practices, with a focus on treating minority and majority shareholders equally and aligning non-financial objectives with strategic positioning (Chiaramonte et al., 2021). In light of this, there is concern about the management responsibility of companies and the relationship with stakeholders (Brogi & Lagasio, 2018).

The research question of this study suggests that there is evidence of a relationship between culture and corporate governance (CG). In this context, culture (whether corporate or national) fosters the norms, values, beliefs, and behaviors shared by organizational members, thereby influencing the integration of corporate governance (Gorga, 2004; Ntongho, 2016; Pessoa et al., 2020).

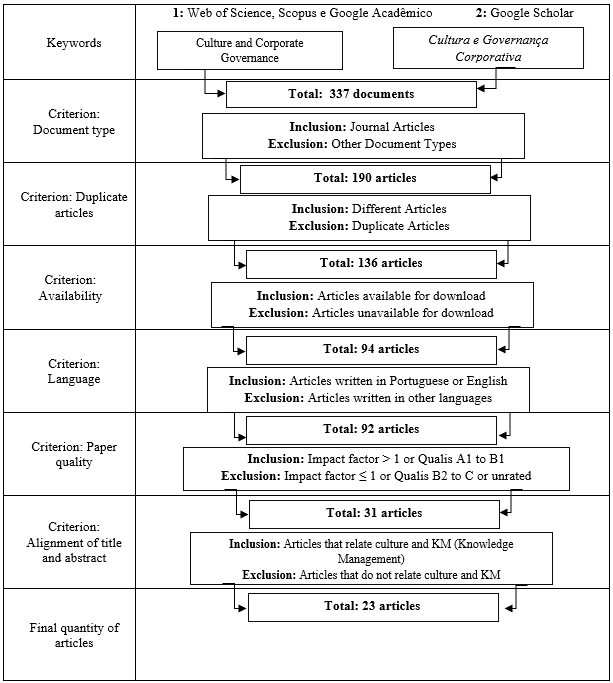

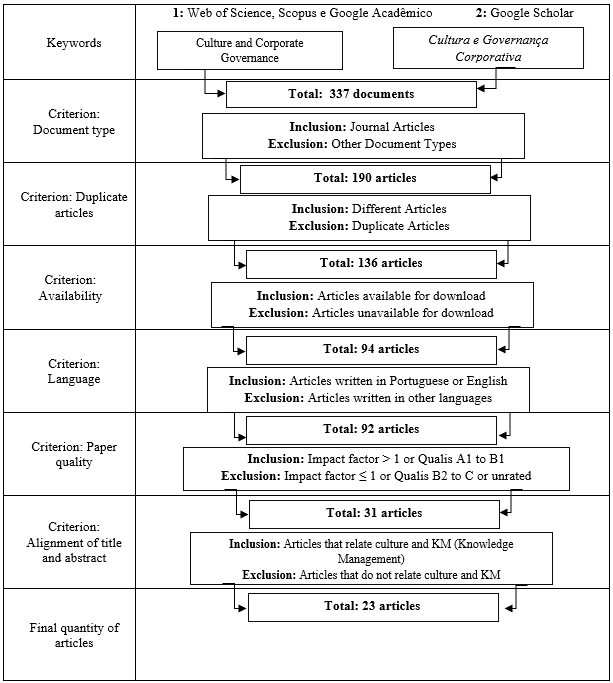

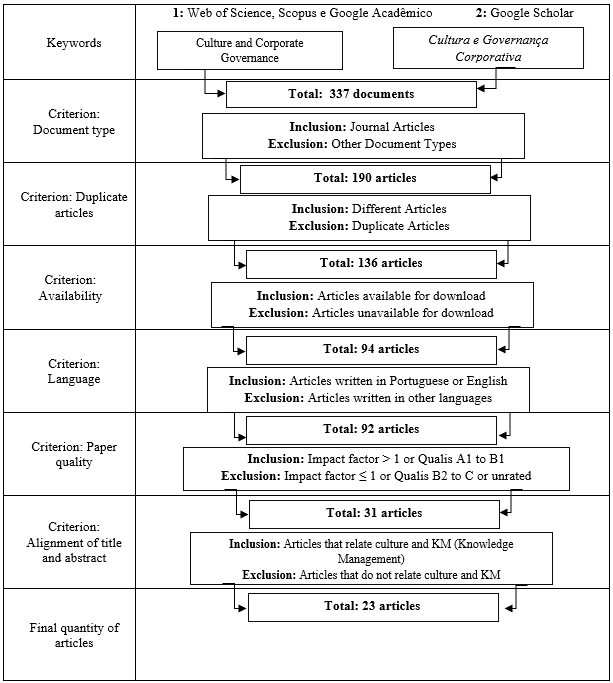

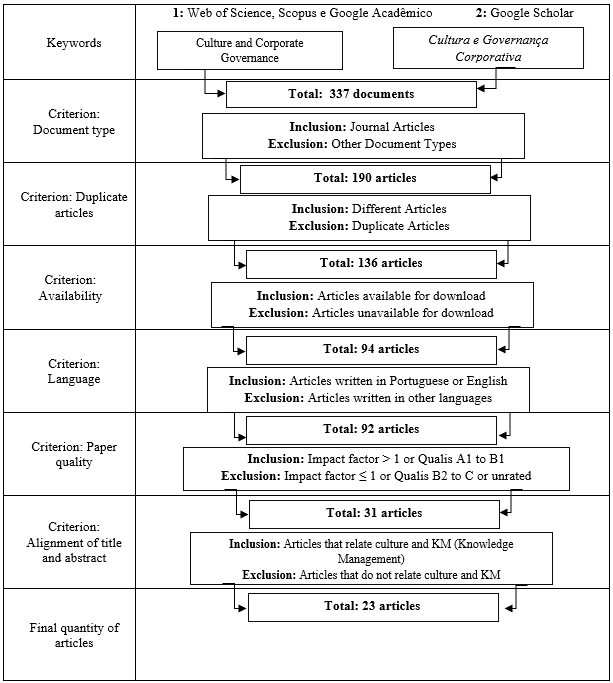

The literature review process for this work followed eight of the nine steps recommended by Donato and Donato (2019). The eight steps proposed by these authors and used in this SLR are: (1) formulating a research problem; (2) defining the inclusion and exclusion criteria; (3) developing a research strategy to find the desired studies; (4) selecting the studies; (5) assessing the quality of the studies; (6) extracting the data; (7) synthesizing the data and assessing the quality of the results; and (8) disseminating the results – publication.

The step proposed by Donato and Donato (2019) that was not considered in this study was to prepare a research protocol and register it in the Prospective Register of Systematic Reviews (PROSPERO). The omission of this step is justified by the fact that it is not usual to register systematic reviews from the field of management and economics in the PROSPERO system, as the protocols submitted there are mostly from the health sector.

It is important that authors specify which searches they will select and which they will exclude (Donato & Donato, 2019). Below, in Table 1, are the criteria for including or excluding items when creating the SLR. Six filters were considered: document type, availability, language, article quality, title alignment, abstract and introduction, and publication period.

Table 1

Criteria for inclusion and exclusion

|

Document Type |

Inclusion: Newspapers |

|

Exclusion: Other types of documents |

|

|

Availability |

Inclusion: Full articles available for download |

|

Exclusion: Articles not available for download |

|

|

Language |

Inclusion:: Articles written in Portuguese and English |

|

Exclusion: Articles written in other languages |

|

|

Quality of articles |

Inclusion: Articles from international journals with a factor of impact greater than 1 and articles from national journal with CAPES rating of A1, A2 or B1, according to Qualis Periodicos 2013-2016. |

|

Exclusion: Articles from international journals with an impact factor less than or equal to 1 and articles from national periodicals with CAPES rating B2 to C, according to Qualis Periodicos 2013-2016. |

|

|

Title alignment, summary and introduction |

Inclusion: Articles dealing with culture and corporate governance. |

|

Exclusion: Other articles that do not mention corporate culture and governance. |

|

|

Period of publication |

Inclusion: Articles published between 1986 – 2020 |

|

Exclusion: Articles published in a year that does not correspond to the period of 1986 – 2020 |

Note. Search Data

It is worth noting that the original survey of articles was structured to cover the 35-year period (1986 to 2020) because of the interest in studying organizational culture in the late 1980s (Silva & Fadul, 2010). Based on the results of the inclusion and exclusion criteria, only articles from 2002 that meet all the conditions outlined in this subsection were found.

The terms used for the search are "culture", "corporate governance", "cultura" and "governança corporativa". Using both English and Portuguese expressions is justified to encompass a wide range of works in both international and national literature, as the topic has been widely discussed worldwide.

The automated search for this SLR considered scientific articles from three databases: Web of Science, Scopus, and Google Scholar. Donato and Donato (2019) advised against using Google Scholar, but it was used for this search because it was assumed that works meeting all inclusion criteria could not be found in the other databases.

The search was conducted in Web of Science and Scopus using the Basic Search tool, with two title filter fields: the first field for "Culture" and the second field for "Corporate Governance." In Google Scholar, articles with the terms "Cultura" and "Governança Corporativa" or "Corporate Governance" and "Culture" in the title were considered.

During the study selection phase, researchers have to review titles and abstracts to eliminate irrelevant documents, collect full texts of potentially relevant research papers, compile multiple reports on the same study, assess whether the papers match the inclusion and exclusion criteria, and make final decisions on study inclusion before actual data extraction (Donato & Donato, 2019).

The steps suggested by Donato and Donato (2019) for study selection were followed in this work. In addition to analyzing titles and abstracts, the introductions were also examined to draw conclusions about the relevance of the studies. By following the steps outlined in the methodology of this thesis, 23 studies with potential relevance to answering the research question were identified. Figure 1 contains the detailed process to arrive at this number.

Donato and Donato (2019) mention that the data extraction requirements vary depending on the specific systematic review and the extraction forms should be customized to fit the research problem. The data extraction form for this research was created using Excel and includes the following fields: Article Title, Author(s), Year of Publication, Journal, Impact Factor or Qualis Capes, Language, Main Objective, Methodology, Main Results, Access Link, Abstract, and Database.

Figure 1

Description and refinement of the research Note. Search Data

Note. Search Data

To illustrate the frequency of the most frequently used keywords in the final sample of articles; a word cloud was created, as shown in Figure 2. The keywords that appeared in at least two articles in the sample include board of directors, corporate culture, corporate governance, corporate social responsibility, culture, disclosure, corporate governance, Malaysia, national culture, Nigeria and organizational culture.

Figure 2

Word Cloud of Keywords

Note. Search Data

The repeated terms in Figure 2 can be divided into two groups. The first group of terms refers to culture, including corporate culture, organizational culture, and national culture. The second group of terms refers to KM, such as board of directors, corporate governance, corporate social responsibility, disclosure, and ‘governança corporativa’. The other keywords, Nigeria and Malaysia, were not included in the groups as they represent the locations from which the studies used data.

The keyword clustering analysis displays the key theoretical elements utilized in the research, along with the phenomena analyzed in connection to the two variables of interest: culture and KM. Another method to identify trends in the discussion of the relationship between the variables is by analyzing the years with the highest number of publications in recent decades.

Figure 3 shows the articles published from 2002 to 2020. During the years 2006, 2008, 2009, 2010, 2011, and 2016, no studies meeting the criteria defined by this study were found. From 2017 to 2020, there was a steady stream of published research, with a minimum of two articles per year.

Figure 3

Articles Published per Year

Note. Search Data

Table 2 displays the number of article publications per journal from 2002 to 2020, along with their respective impact factor or qualis capes. The journals with the most publications, a total of two, were Corporate Governance (Bingley), Journal of International Business Studies, and Management International Review. The journals' impact factor ranges from 1.263 to 9.158, and they are categorized as A2 or B1 in Qualis CAPES (quadrennium 2013-2016). Journals rated as Qualis A1 have not published any articles that meet the criteria outlined in this study.

Table 2

Articles Published per Journal

|

Journal |

Publications |

Impact Factor or Qualis |

|

CORPORATE GOVERNANCE (BINGLEY) |

2 |

2.03 |

|

JOURNAL OF INTERNATIONAL BUSINESS STUDIES |

2 |

9.158 |

|

MANAGEMENT INTERNATIONAL REVIEW |

2 |

2.015 |

|

ABACUS |

1 |

1.975 |

|

ACCOUNTING & FINANCE |

1 |

2.217 |

|

ASIAN BUSINESS & MANAGEMENT |

1 |

2.192 |

|

ENFOQUE: REFLEXÃO CONTÁBIL |

1 |

B1 |

|

INTERNATIONAL JOURNAL OF BUSINESS PERFORMANCE MANAGEMENT |

1 |

A2 |

|

INTERNATIONAL JOURNAL OF DISCLOSURE AND GOVERNANCE |

1 |

A2 |

|

INTERNATIONAL JOURNAL OF MANAGERIAL FINANCE |

1 |

A2 |

|

JOURNAL OF ACCOUNTING AND PUBLIC POLICY |

1 |

2.351 |

|

JOURNAL OF ACCOUNTING, AUDITING & FINANCE |

1 |

1.52 |

|

JOURNAL OF BUSINESS ETHICS |

1 |

4.141 |

|

JOURNAL OF CLEANER PRODUCTION |

1 |

7.246 |

|

JOURNAL OF CORPORATE FINANCE |

1 |

2.521 |

|

JOURNAL OF FINANCIAL RESEARCH |

1 |

1.263 |

|

REVISTA DE ADMINISTRAÇÃO USP (RAUSP) |

1 |

A2 |

|

RESEARCH JOURNAL OF FINANCE AND ACCOUNTING |

1 |

6.26 |

|

LAW & SOCIETY REVIEW |

1 |

1.431 |

|

REVISTA FAMECOS MÍDIA, CULTURA E TECNOLOGIA |

1 |

A2 |

Note. Search Data

When preparing Tables 3 and 4, we considered the variables that were detailed in the methodological procedures sections of the individual articles. Table 3 shows the KM mechanisms used to achieve the results sought by the authors. For each mechanism, there is a short explanation of the highlighted definitions in the articles.

The studies that utilized the mechanisms listed in Table 3 can be found in Appendix 1 using the manuscript numbers. The mechanisms used in at least three articles in the sample include board independence, board size, dual role of the CEO, board role, compensation for executives and directors, institutional holdings, financial disclosure, and internal controls.

Table 3

Details of the operational CG mechanisms

|

Mechanisms |

Detailing |

Manuscripts |

|

Independence of the Council |

Independent directors in the board |

(1) (4) (16) (21) (23) |

|

Gender diversity |

Use of gender-based recommendations |

(16) (23) |

|

Racial diversity |

Racial diversity among board directors |

(1) |

|

Board Size |

Number of counselors |

(11) (17) (23) |

|

CEO Duality |

Leadership structure of the board of directors |

(1) (4) (16) (23) |

|

Existence of committees |

Existing committees to support the council |

(11) (17) |

|

Council meetings |

Frequency of Council meetings |

(16) |

|

Board Roles |

Functions of the Board |

(20) (22) |

|

Audit |

Audit committee practices |

(20) |

|

Anti-acquisition provisions |

Available anti-acquisition strategies |

(8) (20) |

|

Remuneration of executives and directors |

Remuneration of executives and board directors |

(8) (10) (11) (13) (15) (20) |

|

Property Concentration |

Property concentrated on a few shareholders |

(21) |

|

Institutional ownership |

Delimiting organization owners |

(4) (8) (12) (13) (17) (21) |

|

Composition of the Board |

External and internal directors in the board |

(11) (12) (13) (17) (19) |

|

Financial disclosure and internal controls |

Disclosure of financial reports and internal control mechanisms |

(8) (15) (19) (23) |

|

Corporate control market |

Adoption of a shareholder rights plan |

(8) (15) |

|

Family members on the board |

Proportion of family members in the board |

(1) |

|

Qualification of directors |

Proportion of directors qualified in business or accounting in the board |

(1) |

|

Accountability of the Board |

Accountability of the Board |

(8) |

|

Corporate Responsibility |

Business commitment with ethical behavior and concern for economic development. |

(8) |

|

CEO Succession Plan |

CEO Succession Plan |

(19) |

|

CG Culture |

CG culture adoption level |

(19) |

|

Annual Strategic Retreat |

Annual Strategic Retreat |

(19) |

|

Time limits for Directors |

Directors' compliance with deadlines |

(19) |

Note. Search Data

It is clear that mechanisms such as audit activity, board independence, gender diversity, board size, board member expertise, and existence of committees, their independence, and frequency of meetings play a crucial role. The organizational activities can be affected by the cultural norms in the society where the organizations are situated (Freitas et al., 2018; Humphries & Whelan, 2015). These mechanisms are intensively discussed in both academic and practical contexts.

The way in which companies are structured and managed can vary, taking into account the norms, values and beliefs that prevail in a region (Schein, 1984). The cultural system plays a crucial role in the way organizations are managed and operated. The manuscripts highlighted in Table 3 share the common goal of examining the relationship between corporate or national culture and specific mechanisms of governance control. They aim to use the key variables discussed in the literature to answer their respective research questions. Other factors could have been considered in these articles, like ethical codes, communication with stakeholders, and assessment of board performance (Machado Filho, 2020).

Table 4 illustrates the culture-related variables that were used to achieve the authors' intended results. The variables mentioned at least three times are those presented by Hofstede (1980). This author uses the dimensions of individualism, power distance, uncertainty avoidance, and masculinity index to define the values that represent the national culture of the countries.

Table 4

Details of the culture variables operationalized by the articles

|

Variables |

Detailing |

Manuscripts |

|

Values |

Set of shared beliefs |

(22) |

|

Standards |

Concrete criteria that people should use to make choices. |

(22) |

|

Behavior |

What people do or should do |

(22) |

|

Governance Culture |

CG culture adoption level |

(20) |

|

National Culture |

Habits and customs of a nation |

(5) (10) (7) (8) (11) (15) (16) (17) (21) (23) |

|

Individualism |

Individuals only take care of themselves and close relatives |

(5) (7) (10) (11) (15) (16) (17) (23) (21) |

|

Power Distance |

To what extent the members accept unequally distributed power |

(7) (8) (10) (11) (15) (16) (17) (21) (23) |

|

Aversion to uncertainty |

Feeling uncomfortable or comfortable with uncertainty and ambiguity |

(5) (7) (8) (10) (11) (15) (16) (17) (21) (23) |

|

Masculinity |

Valuing achievement, heroism, assertiveness, and material success versus valuing relationships, modesty, care for the weak and interpersonal harmony. |

(7) (10) (11) (15) (16) (17) (21) (23) |

|

Power |

Power of top management |

(14) |

|

Language |

Converging and Divergent Languages |

(12) |

|

Religion |

Converging and Divergent Religions |

(12) |

|

Race |

Social differences based on race |

(1) |

|

Education |

Institutional consequences for accounting values and practices |

(1) |

|

Sustainable culture |

Adoption of sustainable practices |

(18) |

|

Performance orientation |

Performance orientation |

(8) |

|

Future orientation |

Long-term orientation |

(8) (23) |

|

Ethics |

Ethical Behavior |

(6) |

|

Corporate Awareness |

Team engagement through the spirit of the organization. |

(6) |

|

Indulgence |

The way individuals try to control their desires and impulses based on the way they were created. |

(23) |

|

Collaborator Experience |

Professional experience |

(2) |

|

Corporate fraud culture |

Culture of misconduct |

(13) |

Note. Search Data

Culture includes a range of values that vary from one society to another (Hofstede, 1980), shaping organizations and affecting governance control practices (Gorga, 2004; Ntongho, 2016; Pessoa et al., 2020. In addition to the variables studied by Hofstede (1980), authors have also examined the relationship between governance control and power, language, religion, race, education, sustainable culture, performance orientation, future orientation, and corporate consciousness. This highlights the growing significance of cultural factors in the discourse on good governance control practices. Other variables that could be included in these studies are verbal and nonverbal communication, leadership styles, and social hierarchy (Silva, 2022).

This subsection was created to summarize the main contributions of the final sample of this systematic literature review (SLR). For a clearer presentation of the results, the studies were divided into two cultural aspects: national and entrepreneurial.

National culture consists of habits and customs that establish patterns rarely questioned and widely accepted within a society. In addition to Governance Control and other factors, national culture was the most commonly discussed type of culture among the studies in the sample selected for this SLR.

Haniffa and Cooke (2002) conducted the first published study in the chosen sample to explore the importance of cultural characteristics and governance control, along with specific organizational factors, as potential factors influencing voluntary disclosure in the annual reports of listed companies in Malaysia. They discovered significant negative connections at the 5% level between governance control factors (board independence and family dominance on the board) and the amount of voluntary disclosure. The same pattern occurred between the proportion of Malaysian directors (influenced by cultural factors like race) and the level of voluntary disclosure.

The results of Haniffa and Cooke (2002) indicate a negative relationship between board independence and voluntary disclosure. This contradicts the agency theory, which suggests that non-executive chairpersons would serve as a mechanism for implementing good governance control practices. For Malaysia, this finding could suggest recommending a change in governance control practices, as board independence can help keep private information confidential.

Haniffa and Cooke (2005) decided to extend the findings of the 2002 research by conducting a study to improve the understanding of the potential impact of culture and governance control on social disclosure. They discovered a strong connection between social disclosure by companies and boards led by Malaysian directors (a cultural factor), boards dominated by executive directors, chairmen with multiple directorships, and foreign ownership This phenomenon has implications for public policy in Malaysia as well as in several other countries in the Asian region..

There is a clear relationship between cultural characteristics, governance control, and voluntary disclosure practices. This relationship indicates negative associations between cultural characteristics, such as the proportion of Malaysian directors, and the extent of voluntary disclosure of listed companies. This suggests that culture can influence organizational transparency and accountability (Haniffa & Cooke, 2002; Haniffa & Cooke, 2005).

Gorga (2004) conducted her study to analyze Law No. 10.303/2001, to improve investor protection by evaluating its impact on market development. The author studied how Brazilian culture can affect corporate governance control. She pointed out that the proposed law changes did not fully address what could be accomplished in a different socio-cultural context. Instead, they only offered temporary solutions, as the controlling investors agreed to the legislative changes on important matters.

Buck and Shahrim (2005) conducted a study to analyze how national culture influences the implementation of innovation. They illustrated this through case study examples of regulatory and governance control changes in Germany. The authors concluded that analyzing innovation adoption cases related to corporate strategies should involve a deep analysis of the culture of the country. The translation of innovations should be done according to the needs of countries, whether they are collectivist or individualist. It is also important to note that having diverse governance structures can provide multiple solutions for identifying obstacles in corporate performance.

Nakano (2007) examined governance control and business ethics in Japanese companies in search of a desirable business model. The researcher emphasized that implementing governance based on corporate consciousness and establishing corporate ethics through value sharing is the most suitable model for the Japanese cultural and social context.

Bae, Chang and Kang (2012) attempted to answer the following question: In addition to specific organizational factors, legal systems, and governance control systems, what factors could lead to differences in dividend policies between countries? These authors discovered that the culture of a country and investor protection both independently influence the dividend of the policy of a company and have an impact on each other. Strong investor protection leads to higher dividend payments in environments with high uncertainty aversion and/or highly male-dominated cultures.

Clement, Rees and Swanson (2003) identified characteristics of analysts that are associated with above-average performance in companies from ten countries. The authors discovered that the accuracy of forecasts in many of these countries was affected by the years of experience of the analyst, the size of the employer of the analyst, and the frequency of forecast issuance. They showed that the culture type (individualistic or collectivist) and the government control in the country influenced the size and experience of the employer. Analysts in collectivist countries tend to provide less accurate forecasts with increasing years of experience compared to their less experienced counterparts. In countries where governance control focuses on stakeholder interests, the size of the analyst's employer has less impact on the relative accuracy of forecasts compared to countries where governance control focuses on shareholder protection.

Daniel, Cieslewicz and Pourjalali (2012) conducted a study to investigate how the cultural and institutional contexts in which systems of governance control have evolved differ and how these differences affect governance control practices. The results showed that national economic culture influences the institutional environment and thus indirectly influences governance control practices. Efforts to change global governance practices are more closely related to assessing cultural and institutional factors.

Gill (2014) conducted a study to examine the role of culture in explaining international variance in executive compensation practices. The researcher found that cultural and institutional factors related to law and the distribution of ownership might not remain consistent when different definitions of ownership distribution or the legal protections of shareholder rights are considered.

Thus, it is possible to perceive how national culture influences the institutional environment and governance practices adopted by organizations, interfering in issues such as remuneration, investor protection, and innovation (Buck & Shahrim, 2005; Clement et al., 2003; Daniel et al., 2012; Gill, 2014). This suggests that culture can influence governance structures and processes in different countries (GORGA, 2004; NTONGHO, 2016; PESSOA et al., 2020).

Rejchrt and Higgs (2015) investigated whether foreign companies are less compliant with the principles of the UK Corporate Governance Code. The authors discovered that foreign companies from cultures with a high power distance only partially complied with measuring leadership and board effectiveness. The research contributed to the understanding in the UK of how foreign companies operate and the cultural trends related to non-compliance.

With the goal of examining the impact of culture on the governance control system implemented by Switzerland, Volonté (2015) conducted his study. The study found that two-tier boards, where daily corporate management is handled by an executive board separate from the supervisory board, are more common in Swiss-German and Protestant environments. In other ways, unitary boards, which are centralized corporate bodies responsible for daily business and management oversight, are more common in organizations located in Swiss-French and Roman Catholic environments. Additionally, the choice of language (French or German) significantly influences the composition of the board.

Osemeke and Osemeke (2017) studied the effect of culture on the implementation of Governance Control practices in Nigeria by conducting interviews with 32 employees. The researchers found that when management controls are strong and governance control is effective, employees would collaborate as a team to achieve the company goals, thus improving each individual performance. In situations where governance control is compromised due to a lack of enforcement of regulations and flaws in the legal system, some influential staff members and board members may exploit their positions to exert influence over governance control, avoiding oversight and engaging in theft and fraud.

Humphries and Whelan (2017) conducted a study to examine the relationship between national culture and optimal governance control methods. The four characteristics of Governance Control—board independence, gender composition, board leadership, and meeting frequency—and Hofstede's (1980) cultural dimensions were found to be significantly correlated. Organizations considering international collaborations or expansions should remember the importance of understanding the cultural influences on board characteristics.

The study in 2018 investigated how national culture and governance control impact Corporate Social Responsibility reports, specifically examining the influence of governance control on the relationship between reports and culture. The results showed that companies from countries with lower power distance and individualistic societies tend to produce more corporate social responsibility reports. Corporate social responsibility reporting is strengthened by governance control, which takes the shape of social responsibility committees. Furthermore, according to Mohamed Adnan, Hay, and Staden (2018), governance control moderates certain harmful cultural behaviors in the report-producing process.

The impact of Governance Control culture on the financial performance of Nigerian banks was studied by Osho and Blessing (2018). The findings showed that low loan deposit rates and asset quality had a detrimental impact on the financial performance of the banking industry. In light of this, the authors recommend that banks establish a global governance control strategy to set an example for the rest of the banking industry. They also suggest that banks should accelerate the application of international accounting conventions to all their financial transactions.

The article by Griffin, Guedhami, Kwok, Li, and Shao (2017) suggests that culture influences a trade-off between managerial expertise and certainty of control. Scholars have overlooked this trade-off until now. The authors found that the effect of culture on governance control varies across organizations with different levels of managerial expertise and assurance of control. In addition, culture interacts with other factors such as the extent of legal protection and the development of the financial market to determine the level of governance control applied by firms.

Agyei-Mensah and Buertey (2019) conducted an academic study to investigate the relationship between culture, corporate governance and risk reporting of listed companies in Nigeria and South Africa. The results showed that power distance is negatively associated with corporate risk disclosure. In other words, companies where power distance is high (low) are characterized by lower (higher) corporate risk disclosure.

In this sense, it is observed that there is a complex interaction between culture, corporate governance and other factors such as the legal protection of shareholders, the development of the financial market and power distance (Griffin et al., 2017; Agyei-Mensah & Buertey, 2019). These authors have shown that culture can moderate the relationships between these factors and governance practices.

Based on the Transaction Cost Economics Theory, Pessoa et al. (2020) investigated the relationship between national culture and corporate governance (CG). The results showed significant relationships between national culture variables and board size, female participation, CG disclosure and board independence. In light of these findings, companies should consider national culture in their CG practices.

Considering the evidence found in the mentioned studies, it is possible to emphasize that national culture can influence corporate governance practices in various ways, especially in terms of reporting disclosure, board structures, compensation, investor protection, and innovation (Griffin et al., 2017; Humphries & Whelan, 2017; Volonté, 2015). Depending on the nationality studied, the results may contradict the theories held in academia, as was the case with Haniffa and Cooke (2002).

The studies on national culture and CG include a considerable amount of relevant research overall, but new research can be conducted. There are still unanswered questions, especially in the area of Brazilian studies and other emerging countries. Researchers could investigate the variables that mediate the relationship between culture and corporate governance in developing countries, as well as the differences in this relationship between developed and emerging countries (Daniel et al., 2012; Rejchrt & Higgs, 2015).

In addition, it is recommended to conduct studies on the relationships between CG and national culture using various data sources from media such as newspapers, social networks and magazines (Haniffa & Cooke, 2005). In addition, to analyze longitudinal changes in the relationship between culture and CG using time series data (Agyei-Mensah & Buertey, 2019; Pessoa et al., 2019; Rejchrt & Higgs, 2015).

Corporate culture is a set of norms and values that determine the beliefs, behaviors and habits of employees within an organization. Lopes et al. (2014) (2014) was the first to address organizational culture within the selected sample and published this work in a Brazilian journal (Revista Famecos Mídia, Cultura e Tecnologia).

In the study by Lopes et al. (2014), the authors argue that the implementation of corporate governance (CG) may require a cultural change within the organization. These authors emphasize that CG must reinforce the behaviors of its participants and support the principles and values that ensure a healthy relationship between the company and its stakeholders.

Tan, Chapple, and Walsh (2015) analyzed the relationship between corporate governance (CG) and financial performance by conditioning the culture of corporate fraud on fraudulent companies from 2000 to 2007. The authors found that CG is an endogenous characteristic that has no causal impact on corporate performance when considering fraud. Therefore, the global economic impact of fraud at the firm level is highly variable.

Salvioni, Franzoni, Gennari, and Cassano (2018) conducted a study to encourage a discussion on the successful implementation of a sustainable approach by corporate boards, which is crucial for aligning corporate governance (CG) systems. The authors found that companies characterized by sustainable governance could be more attractive to investors, increasing their chances of obtaining resources and increasing their capital value. In addition, adopting the values and principles shared by leaders and companies promotes good governance practices, enables an effective and efficient management approach, facilitates the building of strong relationships between the company and its stakeholders, and improves risk management.

Aggarwal, Schloetzer and Williamson (2019) examined the impact of governance mandates on long-term value; they also evaluated how the councils, most affected by mandates, modified their non-binding CG practices. The researchers documented a gap in the continued use of less shareholder-friendly non-binding governance practices. The results also show that governance mandates can reduce, but not eliminate, the value gap between poorly governed companies.

Lobrij, Kaptein and Lückerath-Rovers (2020) developed a study to provide insights into the inclusion of corporate culture in national CG codes. These authors helped create a multi-dimensional model for evaluating the content of national codes in terms of corporate culture inclusion. They identified three key dimensions: layers of corporate culture, alignment of corporate cultures within the organization, and the role of the board of directors in relation to corporate culture. The results show that five out of the 88 national CG codes analyzed achieved the highest level in all three dimensions of corporate culture.

In general, these authors emphasize the connection between corporate culture and governance, demonstrating that organizational culture plays a crucial role in the implementation and effectiveness of governance practices in companies. In this way, organizational culture influences behaviors, policies, values, and decision-making, affecting the way governance is conducted and its outcomes. When organizations prioritize corporate culture as a key component of CG, they can enhance their practices, foster positive relationships with stakeholders, and improve risk management. In this sense, it is stated that the internalization of values and principles shared by managers can promote good corporate governance practices.

The aim of this review was successfully achieved in understanding the current state of the science on the relationship between culture and CG. It took into account papers published in the last two decades. In the initial phase of this SLR, the search resulted in 337 documents. After applying the selection criteria, 23 articles were chosen to represent the final set.

The variables used in the studies to represent CG and culture vary significantly. For CG, the following variables were most frequently used: Board independence, board size, CEO duality, board responsibilities, executive and director compensation, institutional ownership, and financial disclosure and internal controls. Hofstede (1980) lists some variables that are most commonly used to measure culture: Individualism, distance from power, aversion to uncertainty and masculinity index.

It is recommended for organizations to make use of the positive elements of the culture in the country where they are based (Pessoa et al., 2020), and integrate them into the development of the corporate culture. By influencing the CG, its mechanisms can become stronger (Daniel et al., 2012). In this way, employees will work together as a team to achieve the organization’s goals, which will improve the performance of each individual and the company. In addition, we should incorporate the best practices of CG, considering the specific nationality and circumstances.

The limitations in the development of this study are well known. By carefully defining the inclusion and exclusion criteria, many studies that could have shown robust results were not included in this SLR. The results could be made more robust by using statistical methods. In future reviews, along with advanced statistical methods, the inclusion and exclusion criteria could be more flexible. This could involve considering what is often called "gray" literature, such as dissertations, articles in conference proceedings, and books, to encompass a wider range of outcomes from various data sources.

The journals with the most publications, a total of two, were Corporate Governance (Bingley), Journal of International Business Studies, and Management International Review. The Brazilian surveys have a weakness: national journals rarely publish papers that explore the connection between CG and culture.

Finally, new studies could emerge to investigate which aspects of organizational culture have the biggest impact on corporate governance practices. In addition, research can explore the variables that mediate the relationship between culture and CG in developing countries, as well as the differences in this relationship between developed and emerging countries.

Aggarwal, R., Schloetzer, J. D., & Williamson, R. (2019). Do corporate governance mandates impact long-term firm value and governance culture? Journal of Corporate Finance. https://doi.org/10.1016/j.jcorpfin.2016.06.007

Agyei-Mensah, B. K., & Buertey, S. (2019). Do culture and governance structure influence extent of corporate risk disclosure? International Journal of Managerial Finance, 15(3), 315–334. https://doi.org/10.1108/ijmf-09-2017-0193

Alvesson, M. (1989). Concepts of organizational culture and presumed links to efficiency. Omega, 17(4), 323–333. https://doi.org/10.1016/0305-0483(89)90046-7

Assunção, R. R., Luca, M. M. M. D., & Vasconcelos, A. C. de. (2017). Complexity and corporate governance: an analysis of companies listed on the BM&FBOVESPA. Revista Contabilidade & Finanças, 28(74), 213–228. https://doi.org/10.1590/1808-057x201702660

Bae, S. C., Chang, K., & Kang, E. (2012). Culture, Corporate Governance, and Dividend Policy: International Evidence. Journal of Financial Research, 35(2), 289–316. https://doi.org/10.1111/j.1475-6803.2012.01318.x

Brogi, M., & Lagasio, V. (2018). Environmental, social, and governance and company profitability: Are financial intermediaries different? Corporate Social Responsibility and Environmental Management, 26(3), 576–587. https://doi.org/10.1002/csr.1704

Buck, T., & Shahrim, A. (2005). The translation of corporate governance changes across national cultures: the case of Germany. Journal of International Business Studies, 36(1), 42–61. https://doi.org/10.1057/palgrave.jibs.8400109

Chiaramonte, L., Dreassi, A., Girardone, C., & Piserà, S. (2021). Do ESG strategies enhance bank stability during financial turmoil? Evidence from Europe. The European Journal of Finance, 28(12), 1–39. https://doi.org/10.1080/1351847x.2021.1964556

Clement, M. B., Rees, L., & Swanson, E. P. (2003). The Influence of Culture and Corporate Governance on the Characteristics That Distinguish Superior Analysts. Journal of Accounting, Auditing & Finance, 18(4), 593–618. https://doi.org/10.1177/0148558x0301800410

Daniel, S. J., Cieslewicz, J. K., & Pourjalali, H. (2012). The Impact of National Economic Culture and Country-Level Institutional Environment on Corporate Governance Practices. Management International Review, 52(3), 365–394. https://doi.org/10.1007/s11575-011-0108-x

D´iribarne, P. (1989). La logique d’honneur: Gestion des entreprises et traditions nationales. Paris: Éditions du Seuil.

Donato, H., & Donato, M. (2019). Etapas na Condução de uma Revisão Sistemática. Acta Médica Portuguesa, 32(3), 227. https://doi.org/10.20344/amp.11923

Ferreira, R. M., Lima, S. L. L., Gomes, A. R. V., & Ribeiro, G. (2019). Governança Corporativa: Um estudo bibliométrico da produção científica entre 2010 a 2016. Revista Organizações em Contexto. 15(29), 323–323. https://doi.org/10.15603/1982-8756/roc.v15n29p323-342

Freeman, R. E., Dmytriyev, S. D., & Phillips, R. A. (2021). Stakeholder Theory and the Resource-Based View of the Firm. Journal of Management, 47(7), 014920632199357. sagepub. https://doi.org/10.1177/0149206321993576

Freitas, G. A., Silva, E. M., Oliveira, M. C., Cabral, A. C. A., & Santos, S. M. (2018). Governança Corporativa e Desempenho dos Bancos Listados na B3 em Ambiente de Crise Econômica. Contabilidade, Gestão e Governança, 21(1).

Gill, R. (2014). Law, Culture, and Corporate Governance: Insights from Executive Compensation. Law & Society Review, 35(1).

Gorga, É. (2004). A cultura brasileira como fator determinante na governança corporativa e no desenvolvimento do mercado de capitais. RAUSP Management Journal, 39(4).

Griffin, D., Guedhami, O., Kwok, C. C. Y., Li, K., & Shao, L. (2017). National culture: The missing country-level determinant of corporate governance. Journal of International Business Studies, 48(6), 740–762. https://doi.org/10.1057/s41267-017-0069-9

Haniffa, R. M., & Cooke, T. E. (2002). Culture, Corporate Governance and Disclosure in Malaysian Corporations. Abacus, 38(3), 317–349. https://doi.org/10.1111/1467-6281.00112

Haniffa, R. M., & Cooke, T. E. (2005). The impact of culture and governance on corporate social reporting. Journal of Accounting and Public Policy, 24(5), 391–430. https://doi.org/10.1016/j.jaccpubpol.2005.06.001

Hofstede, G. (1980). Culture’s consequences : international differences in work-related values. Sage Publications.

Hofstede, G. (2001). Culture’s consequences: Comparing values, Behaviors, Institutions, and Organizations across Nations (2nd ed.). Sage.

Humphries, S. A., & Whelan, C. (2017). National culture and corporate governance codes. Corporate Governance: The International Journal of Business in Society, 17(1), 152–163. https://doi.org/10.1108/cg-06-2016-0127

Lobrij, M.-F., Kaptein, M., & Lückerath-Rovers, M. (2020). What national governance codes say about corporate culture. Corporate Governance: The International Journal of Business in Society, 20(5), 903–917. https://doi.org/10.1108/cg-08-2019-0254

Lopes, E. C., Valentim, M. L. P., & Fadel, B. (2014). Efeitos da cultura organizacional no desenvolvimento dos modelos de governança corporativa. Revista FAMECOS, 21(1), 268. https://doi.org/10.15448/1980-3729.2014.1.13830

Machado Filho, C. P. (2020). Responsabilidade social e governança: o debate e as implicações. Cengage Learning.

Mohamed Adnan, S., Hay, D., & van Staden, C. J. (2018). The influence of culture and corporate governance on corporate social responsibility disclosure: A cross country analysis. Journal of Cleaner Production, 198(1), 820–832. https://doi.org/10.1016/j.jclepro.2018.07.057

Nakano, C. (2007). The Significance and Limitations of Corporate Governance from the Perspective of Business Ethics: Towards the Creation of an Ethical Organizational Culture. Asian Business & Management, 6(2), 163–178. https://doi.org/10.1057/palgrave.abm.9200216

Ntongho, R. A. (2016). Culture and corporate governance convergence. International Journal of Law and Management, 58(5), 523–544. https://doi.org/10.1108/ijlma-04-2015-0016

Ola Al Haddad, & Juhmani, O. I. (2020). Corporate Governance and the Insolvency Risk: Evidence from Bahrain. https://doi.org/10.1109/dasa51403.2020.9317279

Osemeke, N., & Osemeke, L. (2017). The effect of culture on corporate governance practices in Nigeria. International Journal of Disclosure and Governance, 14(4), 318–340. https://doi.org/10.1057/s41310-017-0028-5

Osho, A. E., & N, O. B. (2018). The Effect of Corporate Governance Culture of Banks Financial Performance in Nigeria. Research Journal of Finance and Accounting, 9(8), 45. https://iiste.org/Journals/index.php/RJFA/article/view/42011/43255

Parente, P. H. N., Luca, M. M. M.; Lima, G. A. S. F., & Vasconcelos, A. C. (2018). Cultura organizacional e desempenho nas empresas estrangeiras listadas na NYSE. Revista de Contabilidade e Organizações 12(1). https://doi.org/10.11606/issn.1982-6486.rco.2018.139161

Pessoa, F. E. N., Maia, A. J. R., Vasconcelos, A. C., & Luca, M. M. M. (2020). Cultura nacional e governança corporativa em empresas estrangeiras listadas na NYSE. Enfoque: Reflexão Contábil, 39(2), 133–151. https://doi.org/10.4025/enfoque.v39i2.45921

Rejchrt, P., & Higgs, M. (2015). When in Rome: How Non-domestic Companies Listed in the UK May Not Comply with Accepted Norms and Principles of Good Corporate Governance. Does Home Market Culture Explain These Corporate Behaviours and Attitudes to Compliance? Journal of Business Ethics, 129(1), 131–159. https://doi.org/10.1007/s10551-014-2151-6

Salvioni, D. M., Franzoni, S., Gennari, F., & Cassano, R. (2018). Convergence in corporate governance systems and sustainability culture. International Journal of Business Performance Management, 19(1), 7. https://doi.org/10.1504/ijbpm.2018.088490

Silva, L. P. da, & Fadul, É. (2010). A produção científica sobre cultura organizacional em organizações públicas no período de 1997 a 2007: um convite à reflexão. Revista de Administração Contemporânea, 14(4), 651–669. https://doi.org/10.1590/s1415-65552010000400006

Silva, J. P. P. (2022). Cultura Empresarial: O Segredo que faz a diferença entre o comum e o extraordinário no mundo dos negócios. São Paulo, SP: Ideal Books.

Schein, E. H. (1984) Coming to a new awareness of organizational culture. Sloan Management Review, 25(2).

Shleifer, A., & Vishny, R. W. (1997). A Survey of Corporate Governance. The Journal of Finance, 52(2), 737–783. https://doi.org/10.1111/j.1540-6261.1997.tb04820.x

Smircich, L. (1983). Concepts of Culture and Organizational Analysis. Administrative Science Quarterly, 28(3), 339–358. https://doi.org/10.2307/2392246

Tan, D. T., Chapple, L., & Walsh, K. D. (2015). Corporate fraud culture: Re-examining the corporate governance and performance relation. Accounting & Finance, 57(2), 597–620. https://doi.org/10.1111/acfi.12156

Volonté, C. (2014). Culture and Corporate Governance: The Influence of Language and Religion in Switzerland. Management International Review, 55(1), 77–118. https://doi.org/10.1007/s11575-014-0216-5

Yeh, R. S., & Lawrence, J. J. (1995). Individualism and Confucian Dynamism: A Note on Hofstede’s Cultural Root to Economic Growth. Journal of International Business Studies, 26(3), 655–669. https://doi.org/10.1057/palgrave.jibs.8490191

Zhang, H., Babar, M. A., & Tell, P. (2011). Identifying relevant studies in software engineering. Information and Software Technology, 53(6), 625–637. https://doi.org/10.1016/j.infsof.2010.12.010

Articles selected by SLR

|

ID |

Título |

|

1 |

Culture, corporate governance and disclosure in malaysian corporations |

|

2 |

The Influence of Culture and Corporate Governance on the Characteristics That Distinguish Superior Analysts |

|

3 |

A cultura brasileira como fator determinante na governança corporativa e no desenvolvimento do mercado de capitais |

|

4 |

The impact of culture and governance on corporate social reporting |

|

5 |

The translation of corporate governance changes across national cultures: the case of germany |

|

6 |

The significance and limitations of corporate governance from the perspective of business ethics: towards the creation of an ethical organizational culture |

|

7 |

Culture, corporate governance, and dividend policy: international evidence |

|

8 |

The impact of national economic culture and country-level institutional environment on corporate governance practices theory and empirical evidence |

|

9 |

Efeitos da cultura organizacional no desenvolvimento dos modelos de governança corporativa |

|

10 |

Law, Culture, and Corporate Governance: Insights from Executive Compensation |

|

11 |

When in rome: how non-domestic companies listed in the uk may not comply with accepted norms and principles of good corporate governance. Does home market culture explain these corporate behaviours and attitudes to compliance? |

|

12 |

Culture and corporate governance: the influence of language and religion in switzerland |

|

13 |

Corporate fraud culture: Re‐examining the corporate governance and performance relation |

|

14 |

The effect of culture on corporate governance practices in nigeria |

|

15 |

National culture: the missing country-level determinant of corporate governance |

|

16 |

National culture and corporate governance codes |

|

17 |

The influence of culture and corporate governance on corporate social responsibility disclosure: a cross country analysis |

|

18 |

Convergence in corporate governance systems and sustainability culture |

|

19 |

The Effect of Corporate Governance Culture of Banks FinancialPerformance in Nigeria |

|

20 |

Do corporate governance mandates impact long-term firm value and governance culture? |

|

21 |

Do culture and governance structure influence extent of corporate risk disclosure? |

|

22 |

What national governance codes say about corporate culture |

|

23 |

Cultura nacional e governança corporativa em empresas estrangeiras listadas na NYSE |

-----------

[i] Doutorando em Administração pela Universidade Federal da Paraíba, Programa de Pós-graduação em Administração (PPGA), Centro de Ciências Sociais Aplicadas. João Pessoa, Paraíba, Brasil.

[ii] Doutorando em Administração pela Universidade de São Paulo (USP), Programa de Pós-Graduação em Administração, Faculdade de Economia, Administração e Contabilidade (FEA), São Paulo, São Paulo, Brasil

[iii] Mestra em Administração pela Universidade Federal da Paraíba (UFPB). Administradora no Instituto Federal de Educação, Ciência e Tecnologia do Sertão Pernambucano (IFSertãoPE), Gabinete da Reitoria, Coordenação de Correição, Petrolina, Pernambuco, Brasil.

[iv] Especialista em Marketing, Finanças e Empreendedorismo pela União Brasileira de Faculdades (UniBF). Analista Técnica do Serviço Brasileiro de Apoio às Micro e Pequenas Empresas (SEBRAE) PE - Recife, Pernambuco, Brasil.